|

The cream always rises to the top

With 2009 delivering returns beyond many expectations, the question for 2010 is whether the global recovery can continue after the stimulus has dried up. The huge debt issues that we faced 2008 still remain. The debt has simply shifted from the private sector to the public sector as the financial problems have been nationalised. The next stage of the

recovery process is how Governments

intend to manage their debt levels.

As such this issue's features have focused on equity managers closer to home in a bid to try and avoid any direct fallout of any issues that we may see in overseas markets. |

|

|

| |

|

|

Editorial - The cream always rises to the top |

| Looking around Australia’s major cities, one would be forgiven for thinking the Financial Crisis was a figment of the imagination. The question is what happens when the stimulus dries up? |

|

|

|

| |

|

| Commission Rebates - Free Wine Pack |

| As simple as our trail rebate program is, we recognise that it still means taking time out of your day to sit down and fill in our trail rebate form. In appreciation of your participation before the end of June, investors switching to Wealth Focus will also benefit from a Penfolds wine pack. |

|

|

|

| |

|

| Boutique Funds - Little Gems |

| With many investors considering re-entering the markets, we consider the benefits of investing through boutique fund managers. |

|

|

|

| |

|

| Wilson HTM Priority Growth Fund Review - Leading the Way |

|

The Wilson HTM Priority Growth Fund has been the number 1 Australian Equity Fund (3 year performance) in every month in 2009. We consider the benefits of adding this boutique manager to your portfolio. |

|

|

|

| |

|

| Prime Value Growth Fund Review - Flexibility is everything |

| Flexibility to allocate significantly to cash can be an advantage when you see the signs that a market is over-heating. We consider the value of this award winning boutique manager relative to the large managers in the market. |

|

|

| |

|

| |

|

| Planner perspective - Hybrid Securities as a source of income |

| Andrew Reeve-Parker, Director of NW Advice provides a planner perspective into the attraction of Hybrid Securities as a source of income. |

|

|

| |

|

|

| Unlocking Capital Protected Products - Good Money After Bad? |

| Over the last 18 months we have spoken to a large number of clients invested in cash locked capital protected products such as Macquarie Fusion, Reflexion, HFA Octane and Perpetual Protected Investments. As a result, this issue sees us focusing on providing some guidance for investors |

|

|

| |

|

|

| Structured Products - Trends & News |

| The structured products space has seen a resurgence in recent times. Investors have become more active in managing their money and are looking at alternatives for their portfolios. We look at some of the recent product offerings and features available |

|

|

| |

|

|

| Capital Protected Comparison Tables |

| We've done the hard yards for you, allowing you to compare the key features of current products in the market |

|

|

| |

|

|

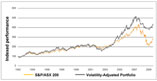

| Volatility overlay within structured products |

| Recent structured products have increasingly used volatility overlays. We explain what this is and how this approach has generally provided investors with a smarter way of investing. |

|

|

| |

|

|

| |