Investment Asset Allocation – Getting the investment mix right

Investment decision-making has traditionally been centred on which funds to choose. However, investment research has shown that, in most circumstances, the asset allocation is the critical factor in determining investment performance over the long term.

It’s the behaviour of the asset class as a whole that makes the difference

Asset allocation – getting the balance between different types of assets right is the cornerstone of successful financial planning.

Investment research has shown that the asset allocation of your portfolio is by far the most important factor in determining investment returns. In fact, the asset allocation decision can be more important than the choice of individual funds themselves.

This makes sense because individual stocks within a particular asset class can be highly correlated and will tend to move together. i.e. It is the behaviour of the asset class as a whole that really makes the difference.

Managing your own portfolio is an emotional roller coaster

It’s only natural that you feel a loss if you worked hard for your savings and then see your investments fall in value. Many investors who have held an investment for a number of years look beyond the potential growth of their investment, feeling that any fall in value they have suffered is not a loss until they finally sell the investment.

On the flipside, many investors who have seen large rises in sectors in the markets feel they are losing out and invest to follow the market, hoping not to miss out.

Using asset allocation strategies to invest in inversely correlated asset classes is a way of taking away the emotional roller coaster associated with DIY investment and giving you a long term track to run on.

Another way of looking at it, is giving yourself a track to run on for your overall investment strategy, you can focus on the fun part which funds and shares to invest into

Diversification reduces risk

It makes sense to diversify your investments and not “put all your eggs in one basket” – if you have everything invested in equities and the market falls you would lose out.

By diversifying the investment portfolio you can reduce risk and still invest in equities aiming for good long-term returns.

Different assets behave in different ways

Since different asset classes behave in different ways, structuring your portfolio with a number of asset classes is one way of reducing the roller coaster highs and lows of investment.

- Cash is typically a very stable market value, but normally provides the lowest return.

- Bonds are relatively stable, low-risk investments but tend to give a comparatively low return.

- Equities are relatively volatile, higher-risk investments but tend to give a better return over the long-term.

- Overseas equities add currency risk and are often even more volatile, but give the opportunity of investing in different markets.

At a simplified level, diversification can be as simple as investing some in bonds as well as some in equities, this would help you compensate for the loss – when equities fall, since bonds typically rise as investment managers and investors look for less volatile investments to sit out a fall in the market.

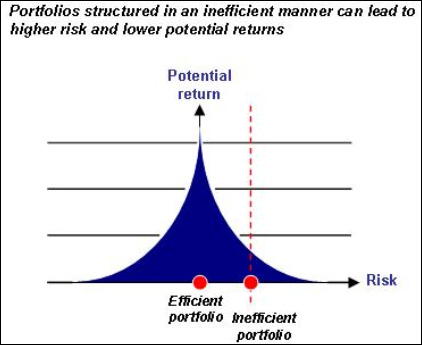

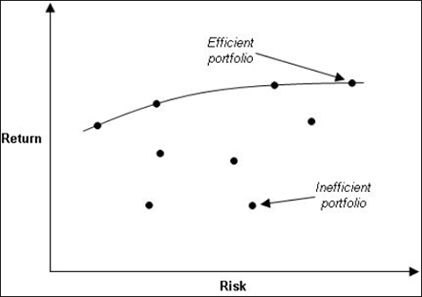

Efficient frontiers – efficient portfolio diversification

For a particular investment portfolio, it is possible to illustrate the potential return and the risk (its volatility). As you might expect, different portfolios will give different risk-return results.

If you calculate the returns achieved using the same amount of risk, you would find some portfolios would give a better investment return than others.

The portfolio giving the highest return for a particular level of risk is the most efficient – it gives the most return possible for a defined level of risk taken.

Regardless of what level of investment risk you are willing to take, constructing and diversifying your portfolio correctly allows you to access the greatest potential returns for your overall level of risk.

Getting the asset allocation right

Ultimately, the right asset allocation for an investor depends on:

- The ability to withstand market volatility (attitude to risk)

- Investment time-frame

- Investment goals

Our Portfolio Planner makes sense of these factors by showing the risk-return profiles personalised to you, to help you find the most appropriate asset-allocation to you.