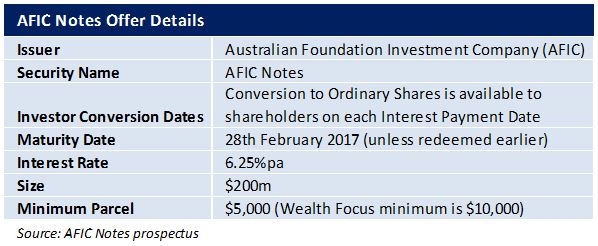

AFIC has just announced the launch of a new income offer: AFIC Notes. The first round of access is through a broker firm allocation, prior to shareholder offer and listing in December.

The Notes will pay a half yearly coupon at 6.25%pa and are due to mature 28th February 2017. The bond will be tradable on the ASX.

This issue will be used primarily to purchase securities of companies should appropriate investment opportunities arise.

A master stroke by AFIC

For those not familiar with the Australian Foundation Investment Company (AFIC), they are Australia’s largest Listed Investment Company and have a history that spans over 80 years and manage in excess of $4 Billion. Their fund invests in Australian equities and is considered by many to offer a low cost index exposure (management fees of 0.17%pa).

You could be forgiven if at first glance you thought that this offer was AFIC’s way of sourcing cheap lending for its managed fund. In essence, you would be correct, but read between the lines and you will see that what is a 5 year fixed income product at 6.25%pa is actually a very clever way of increasing AFIC’s shareholder base.

The issue AFIC faces is similar to that of many managed funds, markets have been falling and investor appetite for equities reducing. So how do you attract investors to buy into a listed managed fund?

Simple, offer them exactly what they want. Offer them a relatively low risk attractive 6.25%pa for 5 years. This provides a return that is in excess of what most banks are paying on 5 year term deposits with the added benefit of daily liquidity to sell on the ASX should investors need to access their capital at an earlier date.

But read between the lines and you’ll see a very attractive conversion option thrown in that allows investors to convert their notes to AFIC shares at any of the half yearly interest dates at 25% over the Volume Weighted Average Price (VWAP) in the 5 days prior to the issue date. In laymans terms, approximately 25% over the price of AFIC shares on the 19th December.

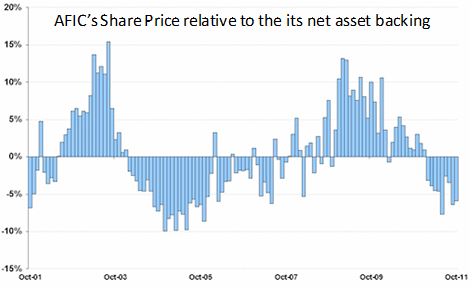

With AFIC’s share price currently sitting at 10% below Net Asset Value (NAV) and historically trading at a premium as high as 13% over the NAV, you can imagine that the board expect a recovery in the market and a return to trading at a premium over the next 5 years is likely to result in investors converting to their Notes to Shares. In effect, investors are receiving a free option over a fund that is generally considered to be index exposure.

Attractive Pricing

In our opinion, the Notes look reasonably attractive on a number of measures;

- 5 year term deposits are typically below 6.00% pa. Term Deposit rates are fixed for five years with financial penalties should you wish to exit early.

AFIC Notes allow you to access a greater 5 year return at 6.25%pa with market liquidity should you wish to exit early (subject to market pricing).

- The conversion option is not dissimilar to having a (American Style) call option over ASX 200 for 5 years with a 25% hurdle. We would expect retail investors to pay close to 15% for this type of exposure, rounding the equivalent return to just over 9%pa.

- Currently there is only $250 Mill of debt against a company of over $4 Billion dollars in assets. An estimated $450 Mill after this raising. AFIC pledge that there will not any prior ranking security without the approval of a Special Resolution of the Holders of AFIC Notes.

We don’t often get too excited about offers but we believe that this is an attractive offer for those investors who are comfortable with term deposit rates of return with daily liquidity and equity upside.

With only $200 Million available, of which $150 Million is set aside for the shareholder offer, we wouldn’t be surprised if these Notes are heavily over-subscribed.

Note: AFIC Notes will be listed on the ASX and as such the price of the Bond’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Comment: