ANZ Bank has just announced the launch of a new income offer: ANZ Capital Notes.The first round of access is through a broker firm allocation, prior to shareholder offer and listing in August.

The Notes will pay a semi annual coupon of 3.4%-3.6% (rate determined by the bookbuild) over the 180 day bank bill swap rate (BBSW), which was 2.82% as of 2nd July, with an initial indicative rate of 6.22%-6.42%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 1st September 2021* and will be tradable on the ASX.

It is expected that the issue will be repaid at the first opportunity in September 2021 with a scheduled conversion in 2023 (subject to mandatory conditions not being breached).

We have covered the features in of fixed income hybrids on numerous occasions over the last 2 years. We would suggest investors who are looking for a basic understanding of how these products work, watch our online video An Introduction to Fixed Income

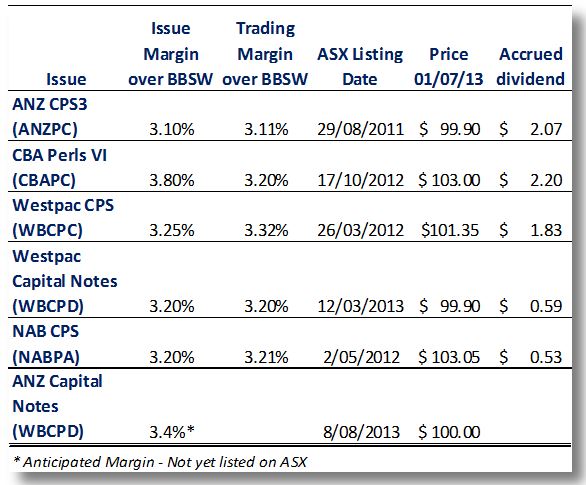

Comparative Securities

The structure of this issue is similar to the recent CBA Perls VI (CBAPC), Westpac CPS (WBCPC), Westpac Capital Notes (WBCPD), NAB CPS (NABPA), and ANZ CPS3 (ANZPC) issues containing capital and non-viability conversion clauses in the event that the companies get themselves into trouble.

ANZPC, NABPA & WBCPC structures offer a margin over the 180 day BBSW, CBAPC and WBCPD offer a margin over the 90 day BBSW.

Arguably, the closest comparables are CBAPC and WBCPD issued in late 2012 and early 2013 respectively.

Our analysis

WBCPD currently trades at $99.90 including a $0.59 accrued dividend (ex. div on 26th August 2013), with an effective margin to expected maturity of 3.20%pa. Similarly CBAPC trades at an effective margin of 3.20%pa over the BBSW.

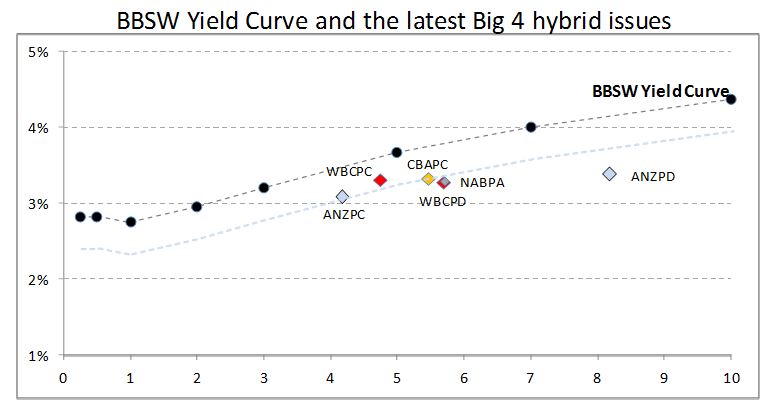

The main difference in considering ANZ Capital Notes versus the existing issues on market is the longer duration of this issue. Relative to the recent issues with an initial call date in 6 years, this issue’s initial call date is 8 years. As a result investors should expect to be compensated for tying up their capital for a longer period. The key question is how much should you be compensated.

Although we have a preference for issues without the Non-viability and Inability Event clauses, there is now an established market among the Big 4, allowing us to compare how they have traded in the secondary market.

Furthermore, using the Bank Bill Swap Rate (BBSW), the rate that banks’ lend money to each other at, we have a reasonable basis of how much you should expect to be rewarded for the extra duration. This would indicate 3.75% is a fair margin. Further factoring in that the wholesale market yield curve is slightly flatter, we would assess a fair margin as 3.65% over the BBSW

The yields reflected are notional yields to maturity – Margins have been manipulated to reflect the benefit of quarterly payments over semi annual payments. CBAPC has been manipulated to reflect the benefit of a higher running yield versus the yield to maturity.

Non-viability Clause, Capital Trigger Event and Inability Event

We wouldn’t be doing you justice if we didn’t again highlight that the new hybrid’s now contain non-viability and capital trigger clauses that should the bank’s Tier 1 Capital Ratio fall below 5.125% or APRA views the bank as non-viable without an injection of capital, the hybrids would automatically convert to ordinary shares.

The most recent bank hybrids have seen a further Inability Event Clause added which states that in the event that the issuer is unable to issue further ordinary shares, ie the company has ceased trading, a Capital Trigger Event or Non-Viability Event, hybrid note holders lose their investment.

Although this is extremely unlikely but reflects the continued increase in risk of the latest bank hybrid offerings. Investors should ensure they get paid a premium for the additional risk they are taking.

For those looking for view of how much you should be getting paid for this additional risk.

It is our view that the institutional investors have generally got a good handle on how much you should be rewarded. The institutional market prices this at around 0.3%pa.

Our View on ANZ Capital Notes

As seems to be the case with any of the bank hybrids, we are certain ANZ will successfully raise the funds they’re looking for at the bottom end of the range (3.40%-3.60% over the 180 day BBSW).

However, unlike the hybrids last year, this year’s issues have had very little meat on them reflecting the banks’ awareness of what they can get away with. Investors continue to be hungry for the perceived security of a Big 4 bank and fixed income products. And if you overlook the longer duration, a 3.4% over the BBSW initially looks like a reasonable margin.

Our view is that longer duration needs to be rewarded with a higher margin and we would like to see this in excess of 3.65% over the BBSW. Furthermore, ANZ has a reputation of taking everything off the table (and the kitchen sink), leaving little support in the after-market.

Alternatively, you may just take the view that the risk of an Australian bank falling on hard times is negligible and just be happy that you are locking in a margin of 3.4% over the BBSW for the next 8 years.

Investors looking toward the Westpac hybrid rumoured to be launched in the next two weeks are not likely to get any relief here either, their in-house planners and anticipated rollover means they can get away with skinnier margins.

In short, if you’re looking for an allocation, we can get you one, but we think investors should sit back on this issue.

Key features

- Indicative floating yield of 6.22-6.42%pa – based on current 180 BBSW of 2.82% and bookbuild margin range of 3.40-3.60%.

- Option to redeem at year 8 with scheduled conversion at year 10 –ANZ has the option to convert in September 2021 or on any subsequent dividend payment date.

- Ordinary dividend restrictions –applies on the non payment of ANZPD dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 8 years –although ANZPD has a 10 year maturity, we think ANZ will redeem/convert at the first call date in September 2021. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: ANZ Capital Notes will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: