Bank of Queensland has just announced the launch of a new income offer: BOQ Capital Notes. The first round of access is through a broker firm allocation, prior to shareholder offer and listing in December. Note: There is no General Offer

The Notes will pay a quarterly coupon of 3.75%-3.95% (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 1.73% as of 23rd November, with an initial indicative rate of 5.48%-5.68%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 17th June 2024** and will be tradable on the ASX.

** It is expected that the issue will be repaid at the first opportunity in August 2024 with a scheduled Conversion in 2026 (subject to mandatory conditions not being breached).

Our analysis

This issue is almost a carbon copy of the SUNPG we wrote about last month. Overall, spreads of the Big 4 bank hybrids have contracted slightly but we would expect 2nd Tier Financials to trade at wider margins than the Big 4 comparables.

This issue is almost a carbon copy of the SUNPG we wrote about last month. Overall, spreads of the Big 4 bank hybrids have contracted slightly but we would expect 2nd Tier Financials to trade at wider margins than the Big 4 comparables.

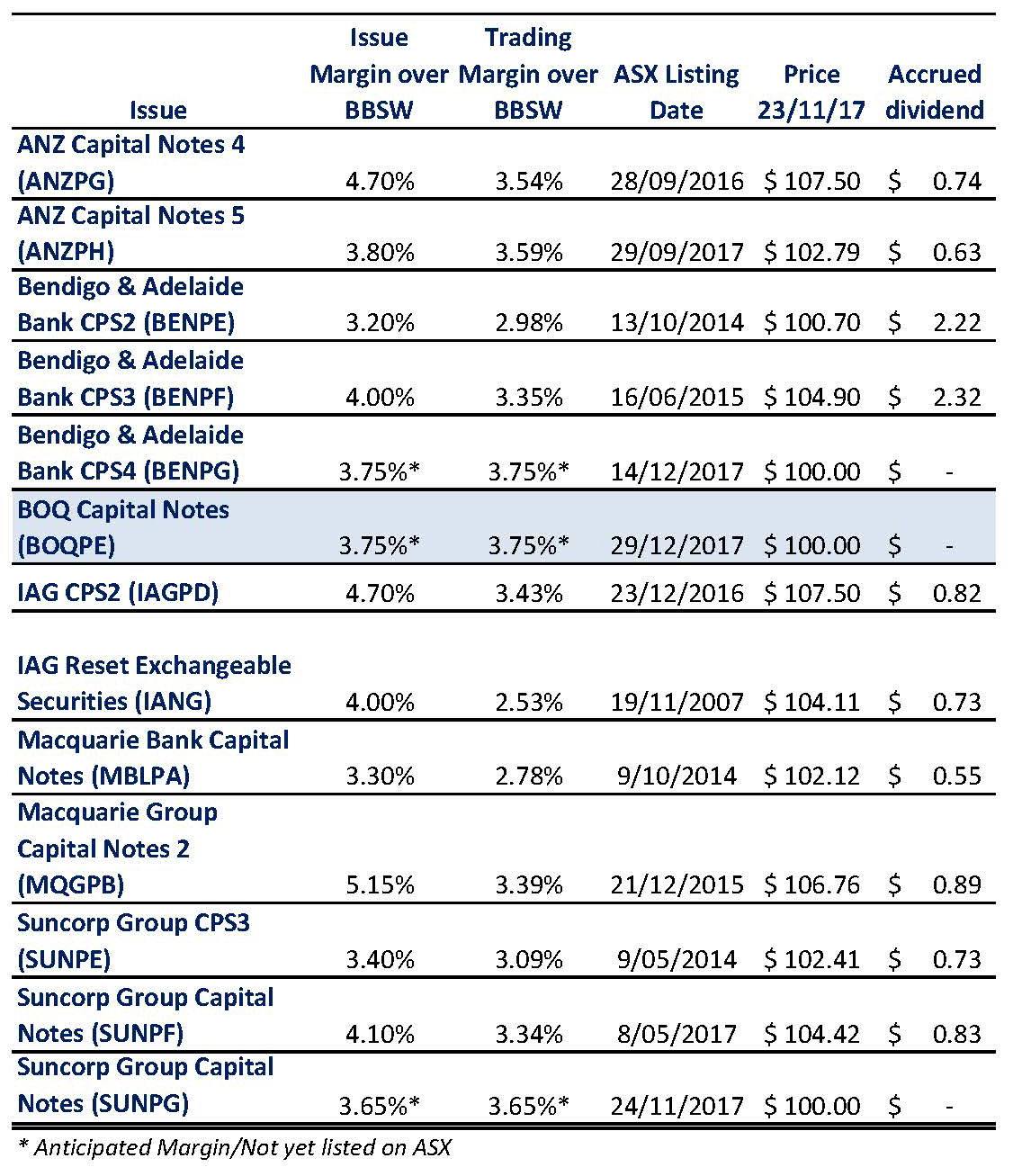

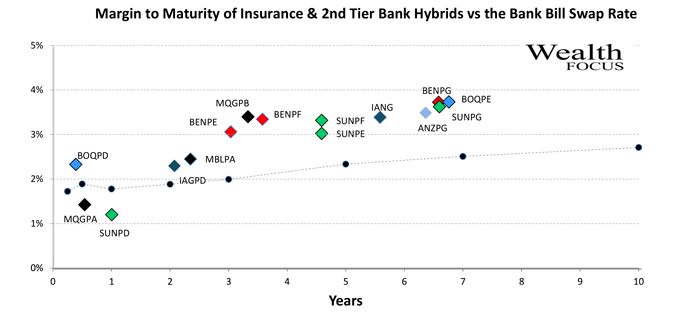

We view Bendigo & Adelaide Bank CPS4 (BENPG), Suncorp Capital Notes 2 (SUNPG) as closest comparables but are yet to trade. ANZ Capital Notes 4 (ANZPG), ANZ Capital Notes 5 (ANZPH) and IAG CPS2 (IAGPD) are the closest comparables currently trading, maturing in March 2024 & 2025 and IAGPD in June 2023.

BOQPE’s margin of 3.75% over BBSW looks to be in line with its peers, but ANZPG, a better quality issuer, trades at a margin of 3.54%pa with a higher running yield.

Non-viability Clause, Capital Trigger Event and Inability Event

Investors who are familiar with the new style hybrids we have seen over the last few years will be very aware of these clauses.

It is useful to understand that these clauses are as a result of APRA requiring further reassurance that in another GFC event, if required, hybrids would convert to ordinary equity, thereby reducing the bank’s debt costs and protecting deposit holders.

Now that banks have to hold a higher level of capital and a better quality loan book, it seems unlikely that any of these conditions would be breached, however, investors would do well to consider the increased disclosure and warnings within each prospectus over the last few years.

For those unfamiliar with the conditions, new hybrids now contain non-viability and capital trigger clauses that should the bank’s Tier 1 Capital Ratio fall below 5.125%, or APRA views the bank as non-viable without an injection of capital, the hybrids would automatically convert to ordinary shares.

We have also seen the introduction of an Inability Event Clause added which states that in the event that the issuer is unable to issue further ordinary shares, ie the company has ceased trading, a Capital Trigger Event or Non-Viability Event, hybrid note holders lose their investment.

This is extremely unlikely, but investors would do well to remember the increase in yield offered carries additional risk.

BOQ Convertible Preference Shares (BOQPD) Reinvestment Offer

This issue is primarily to refinance BOQPD due to be repaid in November this year. Existing BOQPD investors have three options

- Sell BOQPD on market

- Do nothing. BOQ are anticipated to repay BOQPD at the initial conversion date in April 18. However, the Shares could remain on issue until Mandatory Conversion in April 20 (subject to Mandatory Conversion conditions) and BOQPD investors would continue to receive a margin of 5.10% over the BBSW.

- Participate in the Reinvestment Offer before the 15th December and receive 1 BOQPE Note for each BOQPD held plus approximately $0.98 fully franked dividend

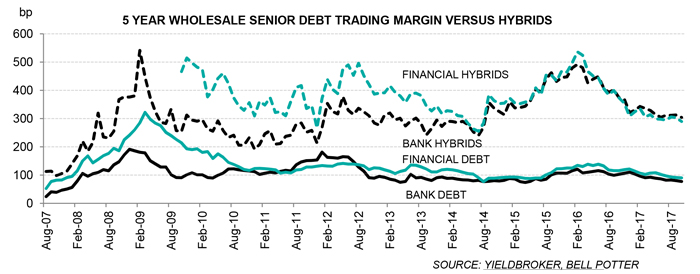

Our view on hybrid margins

As previously highlighted in our October reviews, we maintain the view that hybrid spreads are relatively attractive. The lack of new issuance over the last year has led to a net redemption of hybrids, and money returning to the secondary market, contracting margins.

We are of the view that with reduced pressure on the banks to raise capital ratios, we anticipate the hybrid spreads to continue to contract in 2018.

Our view on BOQ Capital Notes

Investors would do well to remember that this issue’s primary purpose is to replace the $250 Million issue of BOQPE is to replace the $305 Million BOQPD, and as such, new money investment is likely to be hard to come by.

We are certain BOQ Capital Notes will be heavily oversubscribed and close early and at the bottom of the indicative range at 3.75% over BBSW.

Our view is that investors would so well to consider alternatives such as ANZPG in the secondary market trading at a 3.59% margin and a higher running yield with greater security.

However, the lack of BOQ issuance is likely to mean there is significant demand for this issue and lead to this initially trading at premium before eventually settling in line with its peers.

Key features

- Indicative floating yield of 5.48%-5.68%pa – based on current 90 BBSW of 1.73% and bookbuild margin range of 3.75%-3.95%

- Option to redeem at year 6.75 with scheduled conversion at year 8.75 – Bank of Queensland has the option to convert in August 2024

- Ordinary dividend restrictions – applies on the non-payment of BOQPE dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 6.75 years – although BOQPE has a 8.75 year maturity, we view it likely that Bank of Queensland will redeem/convert at the first call date in August 2024. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: BOQ Capital Notes will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investors selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Comment: