Happy New Year and welcome to our first issue of Funds Focus. We have spent the last year researching and developing a unique investment offering which we have designed specifically for the DIY investor.

Our research found that you wanted to be able to invest with ease and with low fees. As a

Many of you contributed to our research in early 2007 which helped guide the features and functionality we have developed. We are constantly improving our service and adding additional functionality not to mention a great range of “Special Offers” for our subscribers. result, our primary focus is to provide “value, information and clarity” to the DIY investor.

Our aim is to provide value, information and clarity

This issue is jam packed with information and offers and we encourage you to check out our informative ‘Back to Basics’ in future issues for the not so experienced investors. We will also be working hard to provide investment opportunities to experienced investors and share traders in future issues.

DIY investor tools, making it easier for you to invest

As an investment professional who as worked in the financial services industry for over 10 years, I realised that it can be overly complicated for planners and investors alike to compare products and make their own investment decisions. I recently viewed a PDS document that was over 200 pages long! I found myself asking how can this be in the interest of investors and disclosure when you are expected to trawl through 200 pages to look for one or two key areas?

I am one of the biggest advocates of disclosure, Product disclosure is one the key reasons that product providers can no longer get away with charging you 4% or 5% each year, but with fund managers charging a wide array of annual management fees, contribution fees, bid offer spreads and plan fees, its getting more and more difficult to compare like with like.

Free managed fund comparison tool

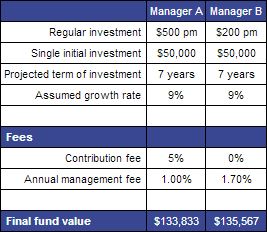

My concern is that the ambiguity that currently surrounds fees only serves to benefit managed fund companies. Planners and investors alike struggle to find out exactly what the overall effect of the deductions is on their managed funds. As a result our first priority was to build a managed fund comparison tool to allow investors to compare like with like when considering the performance vs charges debate.

Register online and download our free managed fund comparison tool, to compare the effect of deductions on your managed funds. www.fundsfocus.com.au/tools

Clarity on fees

A case in point: take two separate managed funds with similar investment objectives and similar anticipated returns. The first charges a low annual management fee with an up front contribution fee, whilst the second charges a higher annual management fee but no additional fees. It‘s not so surprising that in 7 years, when a majority of investors have already switched or considering to switch, that the fund with the lower annual management fee has still not recouped the cost of the initial contribution fees.

Our calculator can also show you how performance fees and additional set up or annual charges can impact on the value of your investments.

Know where you stand!

Whatever your views on the performance versus fees debate, wouldn’t it be good to know exactly where you stand. Register online and access our online investor tools, and remember, all our tools are free to the DIY investor.

The world is changing – Has your portfolio changed too?

The world has changed. Since the start of the new millennium, we have witnessed a global economic revolution. Whilst most of us enjoy the benefits, few of us acknowledge the scope of these changes. Globalisation is now a reality. The price of goods and services we buy from China, India and the former Eastern bloc has played a part in keeping inflation in check, more so than the actions of our own politicians and central banks.

In my opinion, the full significance of this economic revolution has yet to be realised and I believe it will surely change the way we allocate our investments.

The removal of restrictions on trade and capital flows within emerging economies such as China, coupled with rapid technological progress, now means that in the vast majority of cases, businesses in the west are able to source cheaper, and educated labour in the emerging markets.

This process is enriching the population of these emerging markets and creating new investment opportunities for the developed world. This is evidenced in the impact on secondary markets such as what we’ve recently seen in the resurgence of commodities following China’s economic awakening.

The question remains as to whether China can continue its run or whether its too heavily reliant on a slowing US economy.

One thing’s for sure, with the increase in globalisation and industrialisation of the emerging markets, for better or for worse, investing in equities is going to be volatile.

Regardless of the economic climate there are always opportunities

With the recent turmoil and the marked increase in volatility in the markets, many investors have found themselves questioning whether they can get any returns in 2008. I would argue that regardless of the economic climate there are always investment opportunities, you just need to tailor your portfolio and investment strategy towards the opportunities that exist. Take the recent increase in iron ore prices, whilst this is bad news for newly industrialising countries, hungry for iron ore to build their infrastructure, it‘s also good for those rich in iron ore reserves, producing and selling it at a higher price.

One of the worst things the DIY investor can do is do nothing in the hope that outdated investment strategies are going to produce the best returns over the coming year. Taking advantage of cycles in market sentiment and using quality managers is always going to give you the best opportunity to get great investment returns. This month’s issue examines the opportunities that exist as a result of the “new economy”, where they are and how you can minimise some of the resulting volatility.

Comment: