Sandon Capital has announced the launch of a new Listed Investment Company: Sandon Capital Investments Limited (SNC).The first round of access is through a broker firm allocation, prior to the shareholder & general offer and listing in June. Sandon aims to provide investors with a 6c per share fully franked dividend (subject to available franking credits), growth and protect capital. The Shares will be tradable on the ASX.

This issue is the launch of an Activist Investment strategy that aims to provide investor returns by investing in under-valued companies where the Manager considers there to be opportunity to encourage change to unlock a company’s intrinsic value.

With Listed Investment Companies (LICs) back in favour, and many LICs now trading at or above their Net Tangible Assets (NTA) backing, we have seen a number of new fund launches and capital raisings. Sandon Capital’s differentiator is providing access to a strategy that few investors have access to themselves.

We continue to feel that stockpickers are likely to outperform in the short to mid term in what we expect to remain a volatile market. As such, we are attracted by the investment strategy and pedigree of Sandon’s Board. Some of Sandon Capital’s most notable clients, Wilson Asset Management & Mercentile Investment Company (synonymous with Sir Ron Brierley) also provides us with some reassurance that we’re in good company.

Analysis

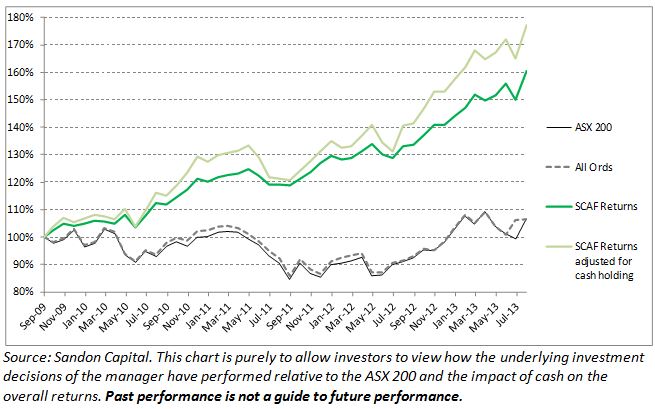

We’ve been keeping a close eye on Sandon Capital’s unlisted fund since earlier this year as the performance has been exceptional. Most notably this performance has been achieved with lower volatility than investing in the ASX 200. However, we note this fund often holds significant levels of cash, which can in turn distort volatility of the underlying investments. In discussions with the portfolio manager Gabriel Radyzminski he points out that the cash is held for a reason and integral to the overall investment portfolio, but we wanted to look under the bonnet.

This also allows us to find out if their returns are due to market movements or their management/alpha generation and if their downside protection was just due to holding cash at the right time or if they were also holding stocks that were less likely to fall in value.

As a result, we re-weighted the returns, adjusting for a cash holding to find out how the underlying investments performed. What we found was volatility was still significantly lower than the ASX 200 and the stock picking ability has shone through.

Key Features

- Limited Offer – The offer is to raise $125 Million, with the ability to raise less. The shares will be traded on the ASX.

- Activist Investment Strategy – A strategy that few investors have the capacity to implement themselves. Activist managers aim to buy shares in undervalued companies and use shareholder rights to proactively re-price the value of the company.

- Free option – Each investor will receive a free option for each share subscribed to in the IPO.

- Dividends –The company aims to return 6c pa to investors plus franking (where franking credits are available)

What we like

- Activist Investing – Value investing is core to our investment philosophy. Activist investing uses the muscle of a large shareholding to do something about it. Warren Buffet is probably the most well known Activist Investor. Investors looking for examples would do well to consider the value unlocked to investors in RHG, Murchison Metals, Australian Infrastructure Fund, and Wallace Absolute Return (now known as Armidale Investment Company).

- Investment Pedigree – Although investors are unlikely to have heard of Gabriel Radyzminski, we take great comfort in his role having advised well known investment houses such as Wilson Asset Management and Mercentile Investment Company. Furthermore, we feel Geoff Wilson’s beating of the drum for Sandon and Matthew Kidman on the board, demonstrates the faith in Sandon Capital’s investment ability.

- Free option– Each investor will receive a free option for each share subscribed to in the IPO. Exercisable at $1, we value the option at between 6-8c.

What we don’t like

- Listed Investment Companies often trade at a discount to NTA – Although we feel this is likely to become less of an issue now that commissions are banned and financial planners are therefore more likely to consider LICs. The discount to NTA is worth noting. Historically LICs can be expected to trade at a premium during a falling market and a discount in a rising market as investor attitudes to the high yield typically on offer changes. Better performing and more established managers are more likely to trade at a premium and vice versa.

- Sandon Capital’s unlisted fund performance was based on a relatively small fund. Although Sandon are in effect managing a much larger pool of money by advising numerous investors in the market, smaller funds are arguably easier to manage and we wonder whether this will impact on their long term performance.

Our view

Overall activist investing is core to our beliefs. Sandon Capital is one of our favoured investments for 2013/14. We believe stock pickers are suited to the current economic environment where insightful research can lead to profiting. The problem for most value investors is they remain at the mercy of the company managers to unlock that value. Proactively using shareholder rights to act in shareholder interests just seems like common sense. We think this investment has the potential to add value for investors. The free option for initial subscribers is just gravy.

Note: Sandon Capital Investments Ltd will be listed on the ASX and as such the price will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: