Reading between the lines

Falling interest rates, increased volatility and uncertainty in the markets has resulted in a rush to offer investors capital protected products.

There are many variations on the theme but most products provide similar features:

1. A guarantee of the return of all (or percentage) of your capital at a fixed date in the future

2. Fixed periods of time, typically 5-7 years

3. 100% investment loans

4. A return linked to an index or to a high profile managed investment fund.

5. Index linked products typically use Bond + Call protection structures, whereas Managed Funds typically use CPPI protection

6. Investment is limited to one fund

7. Early redemption is limited to certain times of the year.

Differentiating between protected products

Although there are numerous products offering protection, protection is generally derived from Constant Proportion Portfolio Insurance (CPPI), or Bond + Call structures. Understanding these two structures will allow you to understand 95% of the structures in the market.

| CPPI | Bond + Call | Dynamic hedging | |

| Performance based on | Managed funds | Index | Managed funds |

| Level of participation in gains of underlying investment | Disinvestment with falls or volatility in the market = less than 100% participation | typically 100%-150% |

100% |

| Cost of protection | Much of the cost is implicit. Lower participation rates typically mean this is lower than Bond + Call or Dynamic Hedging | Much of the cost is implicit. Higher participation rates typically mean this will be higher than CPPI | Explicit costing can make this look relatively expensive. Should cost somewhere between CPPI and Bond + Call |

| Investment loan interest rates | Lower participation rates reduces volatility and the cost of borrowing to invest | Higher participation increases volatility and the cost of borrowing | Should work out somewhere between CPPI and Bond + Call |

| Ability to turn on/off protection | No, in-built for term of product | No, in-built for term of product | Yes |

Deciding which structure to opt for?

Generally speaking the overriding factor in deciding which structure you end up with is dictated by the investment fund that you opt for.

Investments linked to an Index (e.g. ASX 200 Price Index) typically use a Bond + Call structure and investments using a managed fund use a CPPI structure. This is simply because you can’t write options (the investment exposure) on a managed fund.

For many, the underlying structure is perceived as an irrelevant feature. Investors and advisers alike have been far more likely to opt for a product based on the Index or particular Managed Fund headlining the investment.

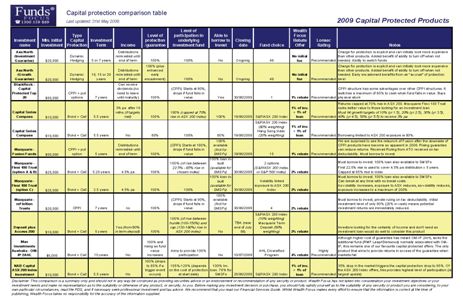

We have put together a comparison list of products in the market to enable investors to readily compare some of the offers currently available. Please click on the image below to download our end year capital protected comparison tables or via our latest offers page to view the most up to date version.

Quick link – Click table to view our end of year comparison of protected products

Comment: