Unlocking Cash Locked Capital Protection

Tackling the shortfall – Where to from here?

Once you have made the decision to move from your CPPI / Threshold Managed Product, for many, the problem is a shortfall on the investment loan. Deciding to redeem your investment early may result in you needing to fund a shortfall between the loan and investment amount.

There have been some efforts to provide an alternative

Perpetual launched their seemingly counter-intuitive “Fund (re-)Participation Offers” last year which consisted of funding an additional 15% to re-enter the same funds that were cash-locked previously and withan additional management fee! We considered this option in detail in January and feel that if you can afford the 15%, try to stretch to the full amount (typically around 20%) and walk away. It seems inappropriate to re-invest in a fund that has already demonstrated it is unsuitable for CPPI capital protection. After all, who is to say that markets will not cause the investment to become cash locked again at some later date. Indeed, this has happened before. Macquarie Reflexion offered investors a “re-participation” solution in 2008 to one of their funds from Reflexion 2007 only to find themselves cash locked again. We would have much preferred to see investors have the ability to choose an alternative fund or the ability to switch to a different protection mechanism.

Macquarie Fusion Funds seem to have offered clients a more preferable solution with their “Switch” product. This allowed investors to move to an alternative protection structure without the need to pay additional money, allowing investors the opportunity to once again participate in growth of the underlying fund without the need to pay significant sums of money. However, there are some shortfalls. Depending on the fund invested in, investors saw some significant caps on the potential returns and so many investors would have done well to consider carefully whether switching within the product or moving out altogether was a better option.

Considering these are two of the largest retail offers in the market, it is a relief to see that effort has been made to find a solution. It is important to note that until recently, investors who were unable to fund the shortfalls for the investment loan had no choice other than to continue haemorrhaging interest costs with no hope of getting anything back at maturity.

Since both providers have stated that they do not expect to offer an alternative option to investors, we have taken the opportunity to highlight a couple of viable alternatives.

NAB – Cash Unlock Alternative

One alternative that is expected to come to market over the next month is NAB Re-Strike. This is anticipated to offer investors the opportunity to receive a 125% capital guarantee at maturity, allowing investors to borrow an additional 25% to pay off the shortfall on their cash locked investment.

This provides investors with an opportunity to roll over into a new capital protected product with the ability to participate in the performance of the underlying investment whilst paying back any shortfall on their original loan. And since the capital protection is not using CPPI/Threshold Management, investors need not worry about becoming cash locked again.

It is rumoured that this will also allow investors to access the RBS the Aquantum Pegasus Index, an absolute return fund that we have highlighted through INstreet Investment recently.

Cash locked investors that are not able to physically fund a shortfall in cashing in their investment would do well to consider this when it is finally launched in April.

A fresh perspective

Another alternative would be to consider just purchasing a separate call option.

Investors can get a $100,000 exposure for only $10-$15,000, offering a far greater opportunity to participate in any market recovery than some of the existing providers’ own efforts.

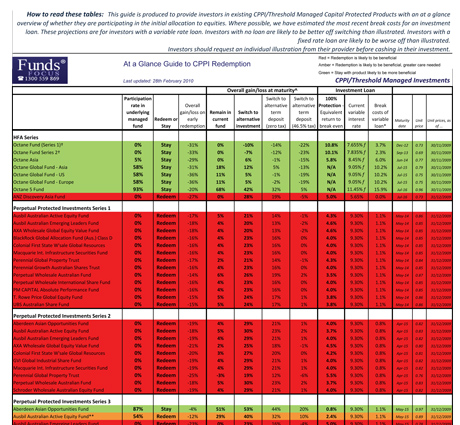

Investors looking for a solution on existing investments should use our guide for an at a glance view of their investments and call us for access to these investment solutions on 1300 559 869.

Quick link – Click table to view our At a Glance Guide to CPPI Redemption

Comment: