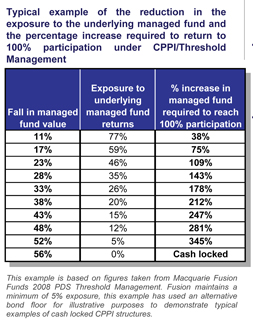

Our June 2009 newsletter featured capital protected products and highlighted some of the pitfalls investors have recently encountered with Threshold Managed/CPPI structures such as Perpetual Protected Investment Series and Macquarie’s Fusion Fund range. Based on the level of enquiry we have had, I feel compelled to revisit Threshold Managed/CPPI capital protection as many of these products are now cash locked (or as good as) with no prospect of achieving a positive return. For many, switching to an alternative product or even simply switching to cash is likely to be a better option *. This is especially the case if you are paying interest on your investment loan at 8-11%pa. Typical example of CPPI/Threshold Management.

Our June 2009 newsletter featured capital protected products and highlighted some of the pitfalls investors have recently encountered with Threshold Managed/CPPI structures such as Perpetual Protected Investment Series and Macquarie’s Fusion Fund range. Based on the level of enquiry we have had, I feel compelled to revisit Threshold Managed/CPPI capital protection as many of these products are now cash locked (or as good as) with no prospect of achieving a positive return. For many, switching to an alternative product or even simply switching to cash is likely to be a better option *. This is especially the case if you are paying interest on your investment loan at 8-11%pa. Typical example of CPPI/Threshold Management.

No hope of benefiting from a rebound in equities

It’s not that CPPI is totally unsuitable, but this type of protection has its limitations. A fall of around 20% in the fund means the underlying investment fund has to rise by around 100% to be fully  exposed again. With falls of up to 50% during the Financial Crisis, many of these structures ended up 100% in cash with no prospect of benefiting from a recovery in equities.

exposed again. With falls of up to 50% during the Financial Crisis, many of these structures ended up 100% in cash with no prospect of benefiting from a recovery in equities.

So why are people still invested in these products?

In my experience the majority of investors (and many advisers!) are just unaware of the problem, however, investors with problematic CPPI capital protected investments can be categorised as follows: Don’t be a cash cow for the product provider and adviser.

The Oblivious – Those that are paying interest each year on the assumption that as markets recover, their investment will once again be re-invested and provide them with more than they originally invested and hopefully make up for the interest they paid along the way.

The Ambivalent – Don’t really care, its part of a large portfolio of “stuff” that they have.

Confused Investors – Typically aware that there is a problem but are unsure as to how to work out whether the costs of cashing in are actually worthwhile.

Advised Investors – A large proportion of investors invested in CPPI products through an adviser and prefer to leave it to the adviser to work out what is  best.

best.

The Educated Investor – They are aware that at the end of the term they will walk away with nothing but can’t afford to cash in early and pay the shortfall on their loan.

Is your investment cash locked and is it worth looking into? I have long felt that the decision making process can be simplified for investors however providers have sat on their hands collecting their management fees for far too long. As a result, we have evaluated each product to provide you with a guide using our own colour coded system ((green – stay) (amber – redeem) (red – redeem)).

Whether you are Oblivious, Ambivalent, Confused or Advised, we hope that this helps you determine whether taking no action at all is actually in your financial interest (not someone else’s!)**.

Quick link – Click table to view our At a Glance Guide to CPPI Redemption CPPI Threshold Managed Guide to Redemtion on cash locked investments.

Comment: