As much as some providers would like you to believe otherwise, it’s not a case of just planting your seed and watching it grow, modern day management is as much about ongoing feeding and nurturing of your crop as it is about finding the right soil conditions and planting your seed.

Ask yourself these questions:

Has this company already produced a crop? And if so, what was the overall return?

Are they a company that was created with the objective of packaging investments for investors, or were they first and foremost a grower that opened up to investors?

More land equals more yield –

When considering similar schemes, a factor to consider is the land your trees/almonds/ grapevines etc are being grown on since less land typically equals a lower yield. There is always going to be an optimum number of plants/trees/shrubs you can grow on a unit of land, simply planting more within the same area is not necessarily going to give you a greater crop, it can in many cases reduce your yield and will have cost you more in planting.

Income streams & plant thinnings –

In an effort to reduce risk and increase investor returns, some schemes have combined a variety of plant species in their offerings taking advantage of earlier thinnings (harvests) of some species to produce an income stream to investors throughout the investment period. This has the combined effect of reducing the risk inherent with one species of plant and ensures that investors receive an early income stream.

Insure your investment –

Whilst many agribusiness providers pool their overall returns to investors, in most cases it is still up to you to insure your plot in the event of disasters such as fire, flood or hurricane. The cost of this insurance is usually negligible and can be arranged with the

agribusiness provider. Although it is unlikely that you’ll ever need to claim on this, you could quickly see your investment wiped out in the event of a natural disaster as you would be removed from the overall pooling.

Investments are less liquid than typical equity based managed funds –

It is important to understand that unlike managed funds, you are not able to sell your investment tomorrow if you decided you needed to access your money and retain the initial tax benefits. Although new rules were passed in 2007 allowing investors to trade their investments (after 4 years), the active market into which you can sell these investments is still relatively small.

Product Rulings are a must –

The ATO regulate the tax deductibility of agribusiness schemes in Australia. Schemes with a product ruling add an additional layer of security in that the investment provider has received prior agreement from the ATO that their scheme qualifies as a tax deductable scheme, on the basis that the manager proceeds with managing the project as outlined in the Product Ruling. So if you are thinking about investing in this type of investment check the ‘product ruling’ on the ATO website (www.ato.gov.au).

Use a discount broker –

With many agribusiness providers paying around 8% in commission to planners, a rebate goes a long way.

So what type of Agribusiness product should I look to invest in?

There is a broad range of agribusiness schemes available to you, each have there own distinctive attractions. However, forestry is the most established and the only sector which has received the grace of the Federal Government in relation to tax deductions going forward. As a result, we have chosen to focus on these projects.

The Global Timber Supply Gap

There is an increasing gap between world supply and demand of timber. Globally, the annual deficit in sawn softwood and hardwood timber is predicted to reach 55 million tonnes and 10 million tonnes respectively by 2010.

The depletion of forest cover in the Asia-Pacific region coupled with increased environmental awareness has turned the wood products trade balance in many countries from a surplus to a deficit.

Coupled with the rising affluence of these regions the deficit in timber production seems likely to rise, further increasing the value of timber products.

Funds Focus investment offer

Forest Enterprises Australia Ltd (FEA) provides what we believe to be one of the best opportunities to access this fast growing sector. First and foremost a forestry company for 23 years, FEA packaged their first retail Managed Investment Scheme in 1993 as a way of sourcing wood for potential future milling.

Since its first offering in 1993, over 8,500 investors have established over 50,000 hectares of FEA eucalypt hardwood plantations in Tasmania, North Coast New South Wales and South East Queensland.

Having distributed its final harvest for the 1993 project in June 2008, FEA are able to demonstrate what most Agribusiness providers have yet to provide, a winning track record. Furthermore, when the thinning and estimated clearfall harvest proceeds are discounted back to 1993 dollars, the total return was more than 50% higher than original 1993 dollar per hectare estimates. The return achieved was a pre-tax return of 12.4% per annum.

FEA’s established timber processing and marketing capacity, and its aim to recover a minimum 40% high-value sawlogs from its plantations, has so far meant that investors have received higher prices at harvest than if logs were only sold as pulplogs.

FEA are currently offering its 16th consecutive Project, FEA Plantations Project 2008. We feel FEA’s history of forestry first, a proven track record that has so far exceeded client expectations and its aim to produce higher value saw wood makes this an attractive investment.

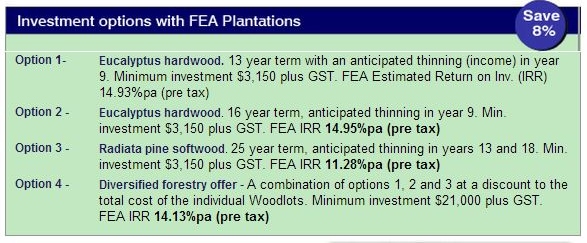

Offering 4 investment options FEA are able to offer investors access to this investment from as little as $3,150 plus GST, receiving a 100% tax deduction against their income tax.

Funds Focus is pleased to be able to offer investors access to FEA Plantations 2008 offering with the full 8% commission rebated in the form of a cheque.

Simply register and request a PDS online at www.fundsfocus.com.au/latestoffers or call on 1300 55 98 69. (Applications must be received before 30th June 2008)

100% lending also available

FEA also offers a range of finance options at competitive fixed interest rates, allowing investors access without having to raise capital from their existing investments.

Comment: