Leading the Way

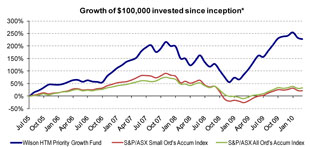

Launched in 2005 to prove the strength of Wilson HTM’s in-house research, the Wilson HTM Priority Growth Fund has provided investors with a return of over 29%pa^ and has certainly proved to be a fund to consider.

Launched in 2005 to prove the strength of Wilson HTM’s in-house research, the Wilson HTM Priority Growth Fund has provided investors with a return of over 29%pa^ and has certainly proved to be a fund to consider.

We have had our eye on the Priority Growth Fund for some time now and have been asked about this fund on numerous occasions.

My initial concerns were whether this boutique manager would be able to continue to produce the goods as the fund grew in size, and whether its significant outperformance in early 2007 was really down to manager performance, or more of a rising tide lifting all boats.

Since then, we have experienced a meltdown in the financial markets, a significant fall in the number of initial public offers coming to market, and the fund has grown from $50 Million to over $115 Million.

Significant Outperformance

In my opinion, any one of these factors alone could significantly impact on the fund’s performance relative to its peers, yet it has continued to outperform and is currently the number 1 ranked Australian Equity Fund over 3 years*.

In my opinion, any one of these factors alone could significantly impact on the fund’s performance relative to its peers, yet it has continued to outperform and is currently the number 1 ranked Australian Equity Fund over 3 years*.

Wilson HTM have certainly proven the strength of their investment team, outperforming the majority of their peers in both rising and falling markets.

We think investors would do well to consider adding this fund as part of their overall allocation to Australian Equities.

Rebate Offer: No Entry Fee

Minimum Investment: $40,000

Disclosure:

Wealth Focus will receive up to 0.6% as a marketing commission from Wilson HTM. This is paid by the manager and is NOT an additional fee to the investor.

Documents & Links:

![]()

![]() Application/PDS link

Application/PDS link

![]() Wilson HTM Priority Growth Fund Summary

Wilson HTM Priority Growth Fund Summary

Wilson HTM Priority Growth Fund webpage

Contact Wealth Focus on 1300 559 869 for more information.

Key Strengths

1. Strong performance – Returning 29% p.a. since its inception in 2005, the Wilson HTM Priority Growth Fund has outperformed its benchmark, the S&P/ASX Small Ord’s Accumulation Index by 24% p.a.^ and is currently the number 1 ranked Australian Equity Fund over 3 years*

2. Priority Access to IPOs managed by Wilson HTM Corporate Finance, allows the fund to benefit from institutional pricing and guaranteed access to sought after capital raisings.

3. In-house investment team – Fund manager, Sandy Grant, attributes much of the Fund’s success to the quality of the in-house research team and guaranteed access to IPOs and other capital raisings managed by Wilson HTM Corporate Finance.

4. Alignment of Interest – Reflecting their strong belief in their own investment philosophy, Wilson HTM Investment Group and its key staff hold 19% of the Fund (as at 28/02/2010).

Comment: