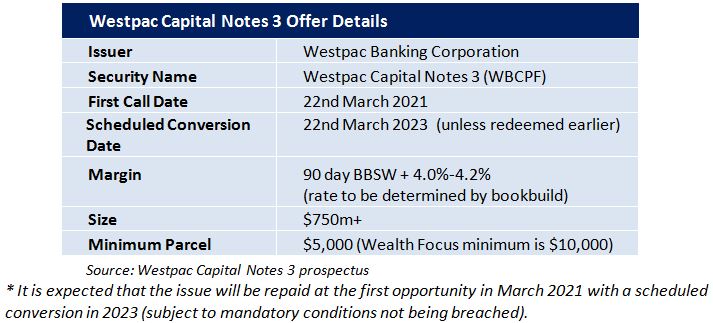

Westpac has just announced the launch of their latest income hybrid: Westpac Capital Notes 3.The first round of access is through a broker firm allocation, prior to shareholder offer and listing in September. There will not be a General Offer for this issue.

The Notes will pay a quarterly coupon of 4.0%-4.2% (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 2.14% as of the 27 July, with an initial indicative rate of 6.14%-6.34%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 22nd March 2021* and will be tradable on the ASX.

How does this compare?

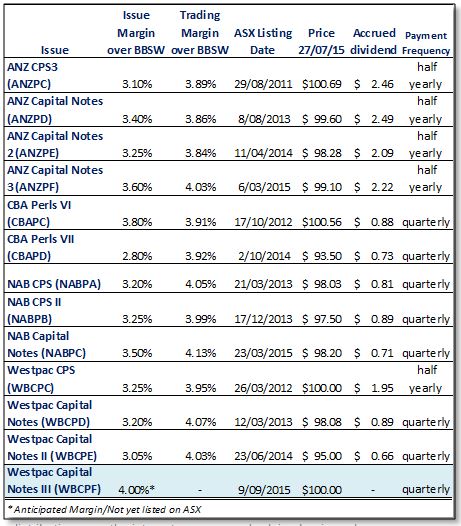

Westpac’s closest comparables are NABPB and ANZPD currently trading at $97.50 (inc. $0.89 accrued dividend) and $99.60 (inc. $2.49 accrued dividend) respectively, with an effective margin to expected maturity of 3.99% and 3.86%.

Westpac Capital Notes 1 (WBCPD) and Capital Notes 2 (WBCPE) are also currently listed, allowing a further comparison against existing issues which trade at margins of 4.07% and 4.03% respectively.

A quick analysis

Westpac’s latest issue, WBCPF which has yet to list, will likely issue at a margin of 4.0%pa over the BBSW. Whilst, in line with the current hybrids on market, this holds the added benefit of a higher running yield which is likely to prove attractive to investors.

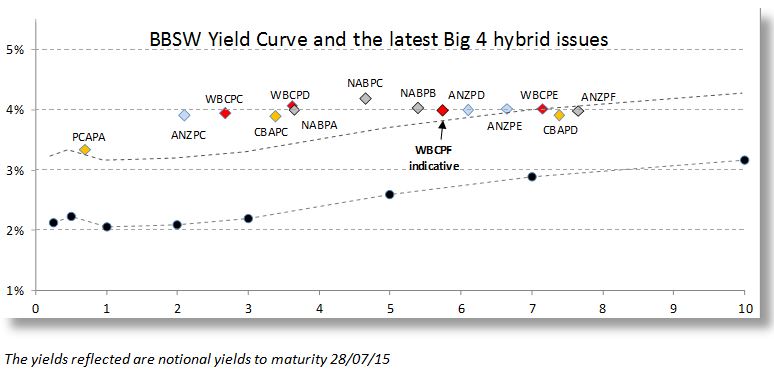

An anomaly has existed in the hybrid market over the last 9 months with the yield curve flattening. Regardless of maturity date, hybrids are offering a similar margin to investors. The only real difference in rates 9 months ago is the spread/margin that is now being offered is 4% versus the 3.5% in October last year.

We have previously reminded investors that a longer investment term should be rewarded with a higher premium. Using the Bank Bill Swap Rate (BBSW) (the rate that banks lend money to each other at) as a yardstick of how institutional investors expect to be rewarded, you can see the effects of this anomaly when comparing the current bank hybrids listed on market.

Depending on your view, this either means that longer dated hybrids are expensive, or shorter dated hybrids are cheap.

Non-viability Clause, Capital Trigger Event and Inability Event

Investors should familiarise themselves with these clauses as we see these as some of the key risks of investing in newer style hybrids. These clauses are now well established within the market and have become accepted as a requirement in order to issue capital that conforms with APRA requirements.

In layman’s terms, should the bank fall on hard times, the hybrids convert to ordinary shares, likely leading to a loss in capital value and in some instances, if the issuer is unable to issue further ordinary shares at time of conversion, hybrid note holders lose their investment.

Clearly this is extremely unlikely and in this type of scenario, you are likely to have bigger things to worry about than just the value of your hybrids, but it reflects the increased risk that note holders have come to accept as the norm with hybrid investment and it would be foolish to think of hybrids as term deposits.

Our View

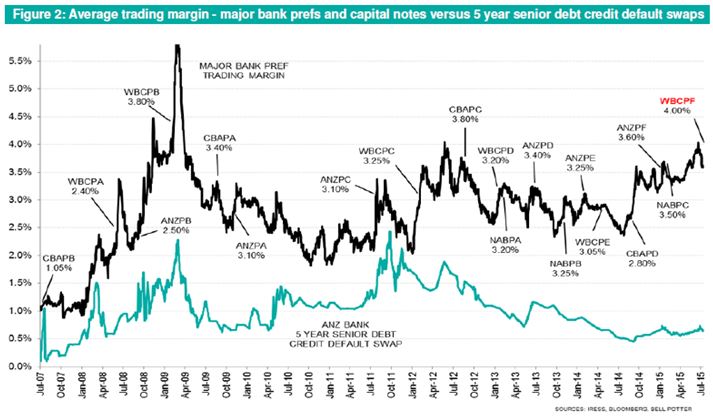

A margin of 4% is exceptionally high for a big 4 bank. The spreads are back close to GFC levels yet the spreads offered on senior debt has contracted reflecting the greater security and contractions in the overall debt markets.

Our view is a margin of 4% over the BBSW is not likely to be around for long and a flat yield curve in this environment is a function of retail mispricing rather than an indication that we are likely to see spreads widen further.

Investors tend to be attracted to a higher running yield, taking the view that they need the ongoing income to live on rather than the overall return to maturity, and as a result we would expect this to trade on a tighter margin than its peers.

Unlike our review of NAB Capital Notes in February where we thought longer dated issues like WBCPE, CBAPD and ANZPF were not adequately rewarding investors for the risk, our feeling is that shorter dated issues are relatively cheap.

With further rights issues anticipated and higher capital ratios required by APRA, the hybrids look to be offering more value than a year or so ago.

There is no general offer (other than an offer to shareholders), stock is going to be hard to find. This will no doubt this will be issued at the bottom end of the range at 4% over the BBSW for an indicative pay rate of 6.14%pa

Key features

- Indicative floating yield of 6.14%-6.34%pa – based on current 90 BBSW of 2.14% and bookbuild margin range of 4.0-4.2%. First payment due on 22nd December 2015.

- Option to redeem at year 5.5 with scheduled conversion at year 7.5 –Westpac has the option to convert in March 2021 or on any subsequent distribution payment date.

- Ordinary dividend restrictions –applies on the non payment of WBCPF dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 5.5 years –although WBCPF has a 7.5 year Scheduled Conversion, we think Westpac will redeem/convert at the first call date in March 2021. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: Westpac Capital Notes 3 will be listed on the ASX and as such the price of the Notes will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: