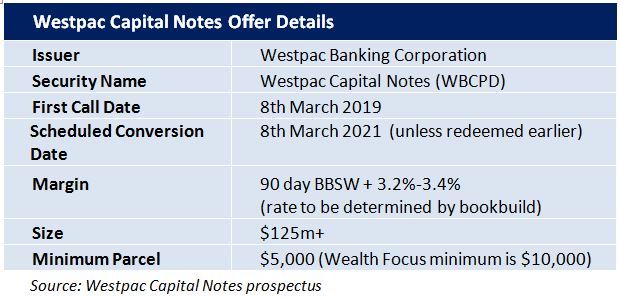

Westpac Bank has just announced the launch of a new income offer: Westpac Capital Notes.The first round of access is through a broker firm allocation, prior to shareholder offer and listing in March.

The Notes will pay a semi annual coupon of 3.2%-3.4% (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 2.99% as of 1st February, with an initial indicative rate of 6.19%-6.39%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 8th March 2019* and will be tradable on the ASX.

It is expected that the issue will be repaid at the first opportunity in March 2019 with a scheduled conversion in 2021 (subject to mandatory conditions not being breached).

Comparative Securities

The structure of this issue is similar to the recent CBA Perls VI (CBAPC), Westpac CPS (WBCPC) and ANZ CPS3 (ANZPC) issues containing capital and non-viability conversion clauses in the event that the companies get themselves into trouble.

ANZPC & WBCPC structures offer a margin over the 180 day BBSW, CBAPC and WBCPD offer a margin over the 90 day BBSW.

Arguably, the closest comparables are CBAPC and WBCPC both issued in 2012.

A quick analysis

WBCPC currently trades at $101.72 including a $2.35 accrued dividend (ex. div on 18th March 2013), increasing the effective margin to expected maturity by 0.11%pa to 3.36%pa.

Reflecting the quarterly distributions, higher rate and the higher regard retail investors hold for CBA, CBAPC trades at an effective margin of 3.23%pa over the BBSW.

Although both offers are relatively similar to Westpac’s latest issue, the Westpac Capital Notes, are almost identical to CBAPC, including the Inability Event that has been added to ensure the hybrids qualify under APRA’s capital requirements.

Non-viability Clause, Capital Trigger Event and Inability Event

We have highlighted several times over the last year that the new hybrid’s now contain non-viability and capital trigger clauses that should the bank’s Tier 1 Capital Ratio fall below 5.125% or APRA views the bank as non-viable without an injection of capital, the hybrids would automatically convert to ordinary shares. The most recent bank hybrids have seen a further Inability Event Clause added which states that in the event that the issuer is unable to issue further ordinary shares, ie the company has ceased trading, a Capital Trigger Event or Non-Viability Event, hybrid note holders lose their investment.

We acknowledge that this is extremely unlikely but reflects the continued increase in risk of the latest bank hybrid offerings. Investors should ensure they get paid a premium for the additional risk they are taking.

Our View – Shhhhhhhh

The lack of new offers over the new year and the recent drop in interest rates has meant investors are chomping at the bit and we are certain Westpac will successfully raise the funds they’re looking for at the bottom end of the indicative range of 3.20%-3.40% over the 90 day BBSW.

We’ve read some of the major broker research out there and many of them have placed fair value at 3.20% over the BBSW, citing the heavy oversubscription of CBAPC in October and that hybrids have since rallied considerably. We say that was then, this is now. That was CBA, this is Westpac.

What they would like to conveniently overlook is WBCPC can be bought on market and is trading at a margin of 3.36% over the BBSW. Furthermore, WBCPC offers slightly better terms (no Inability Event).

Its no secret that companies are queuing up to come to market, the Financial Review has already highlighted NAB as the next favourite to come to market with a hybrid. W

Our view is at 3.20% over the BBSW, there are likely to be better offers, as a result, we’re allowing investors to choose the margin they would like to bid at (up to 3.4%). If you’re hell bent on Westpac, look at the secondary market, but Shhhhhh, we didn’t tell you.

Key features

- Indicative floating yield of 6.19-6.39%pa – based on current 90 BBSW of 2.99% and bookbuild margin range of 3.20-3.40%. First payment due on 8th June 2013.

- Option to redeem at year 6 with scheduled conversion at year 8 –Westpac has the option to convert in March 2019 or on any subsequent dividend payment date.

- Ordinary dividend restrictions –applies on the non payment of WBCPD dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 6 years –although WBCPD has an 8 year maturity, we think Westpac will redeem/convert at the first call date in March 2019. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: Westpac Capital Notes will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: