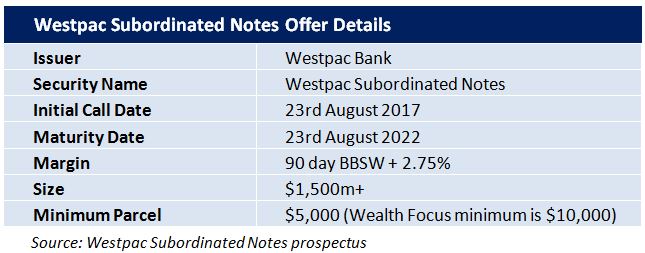

Westpac Bank has announced the launch of a new income offer: Westpac Subordinated Notes (WBCHA).The first round of access is through a broker firm allocation, prior to shareholder and general offer and listing in August.

The Notes will pay a half yearly coupon of 2.75% over the 90 day bank bill swap rate (BBSW), 3.48% as of 23rd July, with an initial indicative rate of 6.23%pa. (The first quarterly price to be set on date of issue) and are expected to redeem 23rd August 2017. The Notes will be tradable on the ASX.

This issue will be used for general funding purposes.

It is expected that the issue will be repaid at the first opportunity in August 2017 with a mandatory redemption in 2022.

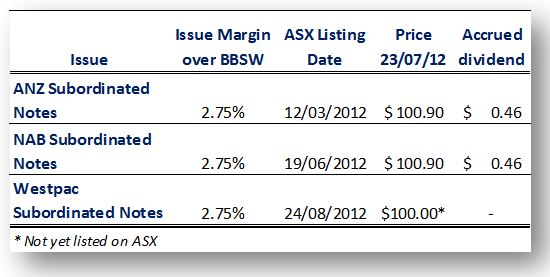

Comparitive Securities

The structure of this issue is almost identical to the ANZ Subordinated Notes (ANZHA) and NAB Subordinated Notes (NABHB) issues. All three structures offer a 2.75% margin over the 90 day BBSW, an initial call date in June/August 2017 and a maturity date in June/August 2022.

It is very easy to get distracted by the yield on offer, 2.75% over the BBSW seems relatively low if you are making comparisons with hybrids such as Westpac CPS (WBCPC) issued in March this year at a margin of 3.25% over the BBSW. We would like to remind investors that WBCHA sits higher up in the debt structure than previous hybrid issues and as such commands a lower interest rate.

We would encourage investors unfamiliar with how these hybrids rank within the debt structure to refer to our initial analysis of ANZ Subordinated Notes in February this year and our recent webinar “An Introduction to Fixed Income”.

Since Westpac Subordinated Notes offer is an almost identical issue to the ANZ and NAB Subordinated Notes, investors can take some assurance from the performance of these Notes on listing. Both issues have held up very well in a falling market demonstrating their appeal to investors looking for more security than previous issues.

Key Features

- Income – Westpac Subordinated Notes provide investors with an indicative unfranked floating rate of 6.23%pa paid quarterly.

- Option to redeem at year 5 with mandatory redemption at year 10 – Westpac is expected to redeem in August 2017.

- Financial Strength – Westpac provides investors exposure to one of the largest companies listed on the ASX and a market cap of over $69bn.

- Quarterly unfranked interest – Often overlooked by investors, hybrid returns are typically quoted inclusive of franking credits. Un-franked payments are therefore more attractive, avoiding the need to wait until the end of the tax year to claim back the franking.

Our view

If you’ve read our review of the ANZ Subordinated Notes in February, there isn’t really much else to add, the Westpac Subordinated Notes offer mirrors ANZ and NAB’s recent issues. We like that these issues are higher up the debt structure and don’t carry the conversion clauses that recent issues such as WBCPC, ANZPC, IAGPC carry should the issuers fall on hard times.

Investors looking to dip their toes in the hybrid market would do well to consider this issue. With ANZHA and NABHB both trading above their face value this also provides an opportunity for investors to roll out and into this issue for a small capital gain.

Note: Westpac Subordinated Notes will be listed on the ASX and as such the price will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: