Whitefield has announced the launch of a new income offer: Whitefield Convertible Resettable Preference Shares (Whitefield CRPS).The first round of access is through a broker firm allocation, prior to shareholder and general offer and listing in August.

The CRPS will pay a half yearly coupon at 7.00%pa plus franking (expected 10%pa gross). The CRPS will be tradable on the ASX.

This issue will be used primarily to expand the underlying portfolio.

Equity returns for fixed income risk

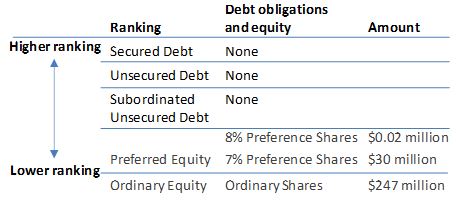

For those not familiar with the Whitefield Limited (WHF), they are one of Australia’s oldest Listed Investment Companies (LICs) with a history dating back to 1923. WHF manage in excess of $247 Million with the majority of the fund investing in ASX 100 Australian equities (excluding resources).

The product disclosure statement states this raising will be used to expand the underlying portfolio. The ancillary benefit of this offer from WHF’s perspective is to expand their shareholder base.

The issue many LICs and unlisted managed funds face right now is that there is little or no inflows as investor appetite for equities has reduced in line with increasing volatility. Investors are unlikely to be receptive to a rights issue to expand their holding as investors have become focused on fixed income in lieu of the current roller coaster ride in equity markets.

Whitefield’s offer is clever in that it is likely to appeal to both fixed income and equity investors. Fixed income investors are likely to be attracted to the security of a 12% Debt to Equity ratio, with security provided by ASX 100 company exposures, a fixed interest rate and the right to convert at face value every reset date. Equity investors will be attracted to equity like returns 10%pa inc. of franking.

Attractive Pricing

In our opinion, the CRPS look reasonably attractive on a number of measures;

- 5 year term deposits are now around 5.5% pa with financial penalties should you wish to exit early.

Whitefield CRPS allow you to access a greater return at 7%pa plus franking with market liquidity should you wish to exit early (subject to market pricing).

- Post issue, there will only $30 Mill of debt against a company of approximately $277 Million dollars in assets, placing Whitefield in a strong position to pay dividends and fund conversion/redemptions.

- As you would expect from an 89 year old Investment Company, Whitefield manages money in a conservative manner, focusing on the ASX 100 and excluding the speculative resource sector from its portfolio.

- Although this is a Perpetual security, Investors have the right to convert at face value at each Reset (the first in Nov 2018).

- The terms of this issue state that dividends are non-cumulative and at the discretion of the Directors such as extreme market conditions. However, we view this as extremely unlikely due to the protection of a dividend stopper to ordinary shareholders. Like many of the older Listed Investment Companies Whitefield investors are typically retirees heavily dependent on income from their investment in Whitefield, we view stopping dividends to ordinary shareholders would cause significant reputational damage and lessen their appeal going forward.

We are surprised that WHF are so generous in this offer and believe that they have left a big profit on the table for investors lucky enough to secure an allocation. This is by far the best initial public offer which we have seen this year following from AFI’s convertible note (ASX code: AFIG) which we thought was the best offer in 2011.

The problem for investors is how to get access to this offer. With only $30 Million available, of which $15 Million is set aside for the shareholder offer, allocation is going to be difficult to source. We have already secured all of our allocation to our advice clients on this issue and would suggest trying the shareholder and general offers.

Key Features

- A small offering of a maximum of just $30 Million (inclusive of $15 Million reserved for the shareholder/general offers)

- Whitefield is a listed investment company operating a relatively conservative portfolio typically exposed to the ASX 100 (exc. resources) and a current weighting towards the banks

- The initial fixed rate of 7% plus franking is likely to be very attractive to retail investors

- Distributions paid are expected to be fully franked but unlike many of the other issues, does not have a guarantee to increase this by the franked amount. Note: Whitefield has approximately $20 Million in accrued franking credits, and we don’t view this as an issue

- Dividend stopper applies to ordinary shares should dividends to hybrid holders stop

- Distributions are discretionary and non-cumulative

- Whitefield’s issue will only represent a 12% debt to equity ratio, (there is no existing debt other than $23k in existing preference shares).

- Certainty of converting at face value at each reset date. First reset date of 30th November 2018.

Note: Whitefield CRPS will be listed on the ASX and as such the price will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: