| |

Prime Value Growth Fund

(No Entry or Adviser Fees) |

Our March newsletter highlighted our concerns of Government debt problems impacting equity markets and that investors should become more selective in the managers they choose over the coming year. Our March newsletter highlighted our concerns of Government debt problems impacting equity markets and that investors should become more selective in the managers they choose over the coming year.

In light of the issues in Europe, we highlighted a preference for Australian Equities, most notably boutique fund managers. We highlighted Prime Value as one of our featured funds as they have a proven history of outperforming the larger Australian equity managers with a lower volatility (risk).

Wealth Focus is pleased to offer investors looking to re-balance their portfolio or re-enter the markets at these lower levels access to the Prime Value Growth and Imputation Funds with a 100% rebate on the entry fee.

Quick Links

- Key Facts (Growth Fund)

- Download/Order a PDS

- Feature on Boutique Fund Managers

Alternatively investors can call us on 1300 559 869 to request a PDS. |

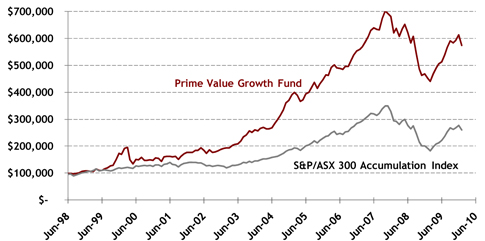

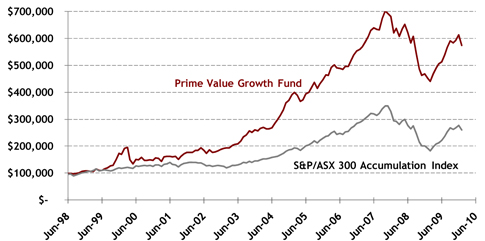

Past Performance (31/01/2010^)

|

^ Past performance is not a reliable indicator of future performance

|

|

|

|

|

|

|

Key

features

- No Adviser Fees - Our commitment to provide the lowest cost for the DIY investors means that readers are able to access this investment with no entry fee and no adviser service fees.

- Higher Returns with Lower Risk - Relative to larger Australian Equity Funds, the Prime Value Growth Fund has outperformed 16 out of the top 20 largest Aussie Equity funds over the last 5 years and yet has managed to maintain a lower level of volatility (risk measure) than 19 out of the 20 largest funds (as of the 28th Feb 2010).

- Flexible Investment Strategy - One of Prime Value's key strengths has been their ability to change their strategy with the times. Initially benefiting from smaller caps the fund has moved towards resources then heavily in cash through the GFC with a more recent move towards larger cap stocks.

- Alignment of Interest - Highlighting a commitment to the investment philosophy, Prime Value's key staff held 4% of the Fund as at 28 February 2010.

- Minimum

Investment - $20,000 (through Wealth Focus)

|

|

|

|

Find

out more

If you would like further information on Prime Value Growth Fund,

please click on the links below:

Alternatively,

if you wish to obtain hard copies or discuss this investment further,

please call us on 1300 559 869. |

|

|

|

|

|

|

| |

What do we get paid?

Wealth Focus will rebate 100% of the 3% sales commission as additional units. Wealth Focus may also receive a trailing commission of up to 0.6% pa. This trailing commission is paid by the product provider and is NOT an additional charge to the investor.

|

|

|

|

|

Contact Details P: 1300 55 98 69 | F: 1300 55 98 70

Office: Suite 7, 49-53 North Steyne, Manly NSW 2095 | Postal Address: PO Box 760, Manly, NSW 1655

Wealth Focus Pty Ltd ABN: 87 123 556 730 ( AFSL No: 314 872 )

© 2010 Wealth Focus Pty. Ltd. All rights reserved. |

|

Contact us Privacy Policy

Disclaimer: This email is issued by Wealth Focus Pty Ltd, *ABN 87 123 556 730, AFSL 314 872. This email, attachments and web links should not in any way be construed as providing securities advice or an endorsement or recommendation of any security or product. In sending you this email we have not taken into consideration your investment objectives or your investment needs and make no representation as to the suitability or otherwise of any product, or security, to you. Before making any investment decision or purchase, you should fully satisfy yourself as to the suitability of any security or product you are considering, to your own particular circumstances, and if necessary seek professional investment and tax advice. We recommend that you read our Financial Services Guide.

If you no longer wish to receive the Funds Focus update your details by forwarding this message

to unsubscribe1 [at] fundsfocus.com.au

|

|