“Give me a lever long enough and I could move the world“ – Archimedes

I am sure the Global Financial Crisis is not quite the context which Archimedes had in mind when he made this statement. Too much easy money has flooded our financial system leading to global repercussions.

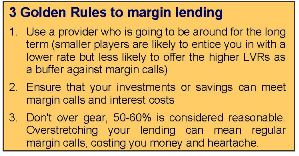

Unfortunately this easy money led to investors taking on too much leverage and investing in assets which have not stood the test of time (Babcock and Brown et al). Lending practices of Opes Prime and the modus operandi of Storm Financial are further examples of what can go wrong with leverage.

However, the principle remains a sound strategy, and with the share market some 30% lower than its peak, we propose that now is the right time to get set and leverage into market leading companies whose future cash flows are well set to see them through the financial crisis.

Opportunity Knocks from as low as 5.89%

From an Australian market perspective, the GFC has contributed to a shrink in the local margin lending industry from $37.1 billion in loans to $21 billion.

The uncertainty in the markets meant that a large proportion of borrowers have become more conservative and paid down their loans to reduce their risk.

This year has seen margin lenders fall into one of two camps, they either see this as an opportunity to gain market share or have shied away from lending risk, offering uncompetitive rates and tightening up on the Loan to Value Ratios (LVRs).

As a result, investors with existing margin loans have an excellent opportunity to refinance their debt, increase their LVR and reduce their interest rate.

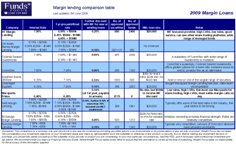

Our analysis of the current rates on offer through Wealth Focus have highlighted Macquarie Prime’s variable rate (5.90%) and BT Margin Lending’s fixed rate (5.89%) as some of the lowest rates currently on offer, allowing investors to access some of the highest LVRs and lowest rates available.

Click to view our comparison of margin loans and discounted offers

Further discounts for higher loan balances

Investors with high loan amounts in excess of $1 Million are typically able to negotiate much lower rates through a broker than dealing direct. Lenders source most of their business through financial planners and are therefore much more likely to offer a broker/planner larger discounts than dealing direct.

Comment: