MARGIN LENDING 2016

| Fee Rebate | N/A |

| Initial Investment | $200,000 |

| Number of funds |

The end of the tax year is upon us and refinancing is at the forefront of margin loan investors thoughts.

We have updated our annual analysis of current offers. As always, rates can vary significantly and investors would do well to shop around.

Pre-paid rates starting at 4.95%

Last year saw lenders throwing caution to the wind matching home loan lending rates. By contrast, despite the RBA dropping rates by 0.5%, margin lending rates have remained the same but still provides a low cost opportunity to clients looking to refinance their investment loans.

Quick Links

Investors should call us on 1300 559 869 to request a quote to secure these rates. Larger loan balances in excess of $1 Million may benefit from further reductions (subject to negotiation).

Key features

- Tax deductible investment strategy – Investors pre-paying interest for the year ahead can claim a tax deduction against this year’s income.

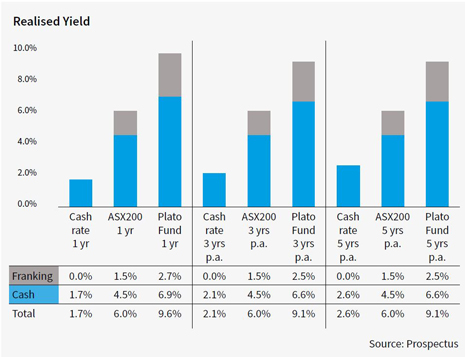

- Magnifying your returns – By borrowing to invest, investors are able to magnify potential increases in the sharemarket recovery (and losses).

- Refinance existing borrowings – Freeing up cash from an existing portfolio of shares, provides investors with the opportunity to refinance against higher rate credit cards and personal loans without giving up potential sharemarket returns.

- Minimum application – $200,000

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: