INSTREET MAST ARC

| Fee Rebate | No loan establishment fee |

| Min Investment | $25,000 |

| Expected Close | 30/06/2010 |

| INstreet Mast ARC provides investors with the opportunity to access a $100,000 exposure in an absolute return strategy for only 6.35% pa. The investment program aims to seek out trends and provide absolute returns from both rises and falls in commodites markets. |

| Key features and benefits |

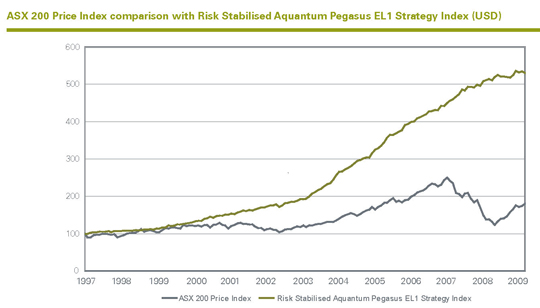

| Potential to benefit in both rising and falling commodities markets – By investing in Instreet Mast ARC investors are able to gain exposure to the growth of the Risk Stablised Aquantum Pegasus EL1 Index.The Aquantum Pegasus EL1 Index aims to deliver absolute returns with a low level of volatility. Based on an extensive 12-year empirical analysis by RBS, the Index has recorded positive returns every calendar year.Computer Driven Trading – 100% systematic and relying solely on computer driven trading, the Aquantum Pegasus EL1 Index identifies trends and exploits inefficiencies in commodity markets around the world.Low correlation with equity investments – It is widely accepted that due to the low correlation of returns with traditional equity portfolios, diversifying with strategies such as the Aquantum Pegasus Index can benefit investors overall performance.Annual payment of any gains – Gains are distributed at the end of each year, allowing investors to lock in their profit at the end of year 1 (or reset at a lower level in the event of a loss) No up front capital required – INstreet Mast ARC encompases 100% investment loan, allowing you to invest without tying up capital. Low cost of borrowing – Investment into Mast ARC is at a low rate of 6.35%pa. Available to SMSFs – Investors have the ability to walk away at any time with no liability to future interest payments. Self Managed Super Funds are therefore able to invest. |

| Past Performance |

|

| Important Information * The returns are based on the increase on the Risk Stabilised Aquantum Pegasus EL1 Strategy Index over the specified month. The simulated performance uses the historical values of the Risk Stabilised Aquantum Pegasus EL1 Strategy Index (USD) as published by Bloomberg. Investors should note that in calculating the simulated returns, they have been calculated based on back-testing using historical data of the Underlying Index from the period of 6 October 1997 until 1 April 2010. All fees, costs and charges of the Underlying Index have been taken into account when calculating the simulated returns. In addition, the simulation assumes that the Reference Index was not terminated by the Reference Index Calculation Agent and where there was a Market Disruption Event or other event which prevented the publishing of a Reference Index Value, the Issuer has used a level on the following Business Day. |

What do we get paid

Wealth Focus will not charge an adviser fee on investments into this product. Wealth Focus may receive up to 0.8% pa as a trailing commission for this product. This commission is paid by the product provider and is NOT an additional charge to the investor.

Comment: