WESTPAC CAPITAL NOTES 3

| Minimum Investment | $10,000 |

| Expected Close | 20/08/2015 |

The latest hybrid issue from Westpac

Wealth Focus has secured access to the Westpac Capital Notes 3 IPO. Investors looking to apply for a broker firm allocation will need to contact us on 1300 559 869 by 12pm on Friday 31st July.

Allocations may still be available after this date but will be allocated on a first come first served basis.

Westpac Capital Notes 3

Westpac have just launched their latest fixed income hybrid investment at an indicative rate of 4%-4.2% over the Bank Bill Swap Rate (BBSW).

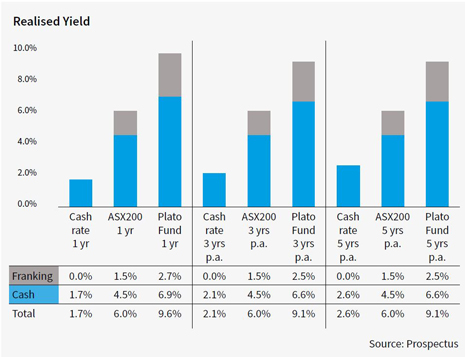

Since our analysis just over a year ago where we highlighted our concerns over low rates offered on hybrids, spreads have widened considerably and banks have been asked to hold more capital on their books. This is good news for investors looking to invest in hybrids as they’re being offered a greater return with more security.

CBA has been the butt of many jokes since issuing Perls VI at a fat margin of 3.8%, but with the recent widening of hybrid spreads again they’re at last being offered some reprieve. Westpac’s issue (likely to be at 4% over the BBSW), will take over the mantle of offering the highest running yield of any of the Big 4.

With volatility once again returning to the markets, interest rates tipped to fall further and retirees chasing income, we feel the fat margins are not likely to be around for too long and offers value to hybrid investors. This issue is likely to close early at the bottom end of the indicative range of 4.0%-4.20% over the BBSW (indicative rate of 6.14%-6.34%pa – 28/07/15).

- Download a prospectus

- Download a fact sheet

- Download our analysis

- Webinar – An Introduction to Fixed Income

Call us on 1300 559 869 to ask us to secure an allocation.

Key Features

- Broker firm offer – Our allocation through the broker firm offer means investors are more likely to achieve their desired allocation without waiting for the shareholder/priority offer. There is no general offer on this issue

- Limited Offer – The offer is to raise $750 Million, with the ability to raise more or less. The Notes will be traded on the ASX.

- Income – Westpac Capital Notes 3cprovides holders with quarterly fully franked distributions.

- High level of income – The indicative distribution rate is 4.0%-4.2% over the 90 day Bank Bill Swap Rate (2.14% – 27/07/15) for an indicative rate of 6.14% pa.

- Minimum investment – $10,000 (this is a Wealth Focus minimum)

- Issue Price – $100

Find out more

If you would like further information on Westpac Capital Notes 3, please click on the links below:

Please call us on 1300 559 869 to ask us to secure an allocation.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

What do we get paid?

Wealth Focus will receive a payment of up to 1% plus GST of the amount invested. This commission is paid by the product issuer and is NOT an additional charge to the investor.

Comment: